Implementing the 2030 Agenda after a decade of unsustainable policies

Canada’s newly-elected federal Liberal government has committed to working towards achieving the goals set out in the 2030 Agenda “both at home and abroad.” However, the government inherits a country that has been profoundly shaped by the conservative economic and social policies of the past decade. The new government will have to overcome the challenges posed by a much-diminished federal government, social and income inequality, and an economy based on growing wealth rather than wages in order to deliver on its commitment to achieving the Sustainable Development Goals.

Canada’s newly-elected federal Liberal government has committed to working towards achieving the goals set out in the 2030 Agenda “both at home and abroad.1” However, the Government inherits a country that has been profoundly shaped by the conservative economic and social policies of the past decade. The new government will have to overcome the challenges posed by a much-diminished federal government, social and income inequality, and an economy based on growing wealth rather than wages in order to deliver on its commitment to achieving the Sustainable Development Goals.

Shrinking government, shrinking services

In sharp contrast to the previous federal Conservative government, the current government has committed itself to resumed deficit spending. However, even with the increases seen in their first budget, federal programme spending remains at a historic low. Today, federal programme spending as a share of the economy stands at 13 percent of GDP, its lowest point in the past 60 years.2

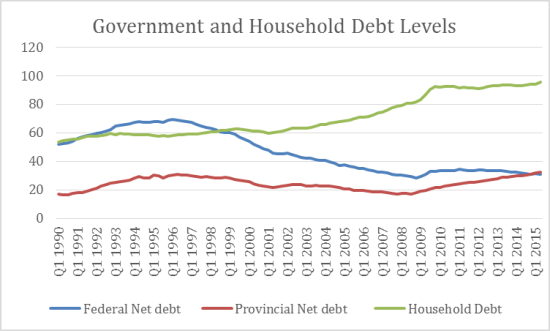

The budget cuts of the past decade were successful in eliminating the federal deficit. However, as the federal government withdrew from providing public services, provincial governments and households took up that responsibility. The result has been both diminished public services and record high provincial and household debt.

For the first time ever, provincial governments, which bear the responsibility for delivering education, social and health services, collectively now hold a higher level of debt than does the federal government.3 Provincial governments, in turn, have shifted the costs of social and economic service delivery to individuals. For example, in the area of post-secondary education, rising tuition rates fill the gap created by shrinking government funding. The result is that the collective student debt load now totals USD 28 billion.4 More broadly, household debt now sits at 96 percent of GDP--higher than the debt of any other sector in the Canadian economy.

|

Source: “Macroeconomic Policy,” Alternative Federal Budget 2016.

Over the past five years an estimated 50,000 federal jobs have been cut.5 The results have included fewer services for those most in need. Those who are unemployed are less able to seek assistance in gaining access to Employment Insurance.6 The Canadian Food Inspection Agency lost 20 percent of its staff, undermining i ts ability to ensure the safety of Canada’s food supply.7 Vete rans’ services are increasingly inadequate after nearly a thousand positions were cut in that department.8

Funding for social and educational services on First Nations reserves have been constrained by measures dating back to 1996—measures which place a 2 percent cap on increases to basic services for First Nations, with no contingency for increased population or levels of need. In 2016 the Canadian Human Rights Tribunal found that underfund ing of child welfare services on one reserve in particular constituted a “discriminatory practice.” The impact of inadequate funding is evident in the tragically high levels of poverty experienced on the reserves, where 60 per cent of First Nations’ children live in poverty.9

The current government made significant new investments into infrastructure, services and education for First Nations communities in its 2016 budget. While this represents a welcome change in direction, the gap in income, employment and access to education experienced by Canada’s indigeno us peoples is still shamefully large. Indigenous peoples are three times as likely to live in housing that is in need of major repairs (a problem that is particularly acute for the Inuit population in the far north of Canada) and over 100 First Nations communities live without safe drinking water.10 Indigenous people experience higher than average rates of incarceration as well as significantly higher rates of violent victimization. The high rates of violence experienced by indigenous women and girls in Canada have been the subject of an inquiry by the UN CEDAW Committee and will be the subject of a forthcoming federal public inquiry.

Cuts to federal spending have also meant less information is available about levels of inequality in Canadian society—the federal statistical agency has lost significant numbers of staff and the long-form census was eliminated in 2010. These cuts mean that Canada is less able to make informed decisions about how to address inequality, poverty and discrimination.

Those seeking to access the justice system to seek redress for discriminatory levels of service provision have been hampered both by the lack of information and by cuts to programmes that supported access to justice, such as the Court Challenges Programme.

The new government has restored the long-form census for 2016 and has promised to reinstate the Court Challenges Programme. However, there will be a historic gap in the collection of information about inequality in Canada which cannot be filled. Many of the organizations which provided support for those seeking to bring rights-based court cases forward have been dismantled.

The new government is moving to address the challenges that the austerity policies of the past decade have set before them. However, the cuts have been so deep that simply returning to 2007 levels will be inadequate to ensure a basic level of well-being is provided for all those living in Canada.

Inequality, wealth and wages

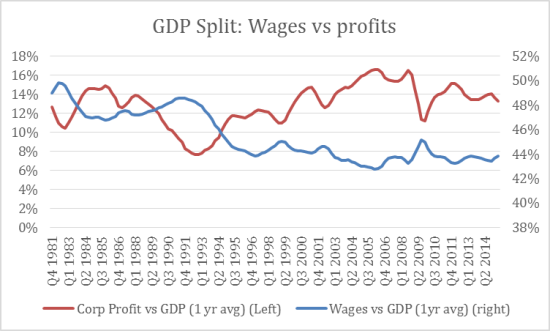

Canada’s economy reflects the global trend towards growth based on the accumulation of wealth by a small sector of the population together with stagnant wages and employment. Although Canada’s regulatory system provided some protection for its financial sector following the 2008 financial crisis, the federal government of the day took on a programme of austerity policies which have further exacerbated economic and social inequality.

|

Source: “Macroeconomic Policy,” Alternative Federal Budget 2016.

Canada’s corporate tax rates are among the lowest of all OECD countries, declining from 29.1 percent in 2000 to 15 percent in 2008. Yet rather than stimulate spending and job creation, business investment as a share of the economy has actually declined and corporations now hold over USD 600 billion in surpluses and excess cash.11

Canada’s employment rate has not recovered since 2008 for adults in their prime working years. Although the unemployment rate has declined, the majority of the decline has occurred because unemployed workers have ceased looking for work not because they have found employment.

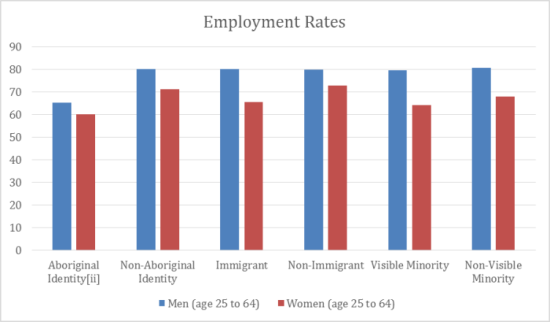

Employment levels are lower still for women, racialized peoples, indigenous peoples, and persons with disabilities. In Canada, women’s employment levels climbed steadily throughout the 1980s and 1990s. However, they still haven’t matched those of men, in spite of the fact that women’s educational levels have surpassed those of men. Women’s levels of full-time work have stagnated in Canada and women continue to be over-represented in low-wage jobs.12

|

Source: National Household Survey 2011.

Just as there are marked differences in the distribution of work between men and women, there are also clear differences between groups of women. Immigrant women’s employment lags 7 percent behind that of Canadian-born women and 14 percent behind tha t of immigrant men.13 Aboriginal women’s employment rates are 5 percent below those of Aboriginal men and 11 percent below those of non-Aboriginal women.14 The se gaps persist in spite of the fact that immigrant women have higher levels of education, as a group, than do non-immigrant women. The discrepancy between qualifications and access to work illustrates the persistent power of discrimination in maintaining inequality.

The gaps in access to paid work are mirrored in the discrepancies in the wages paid to differe nt groups of workers in Canada. Women continue to see their paid work underval ued. The gap in men’s and women’s incomes is not simply the result of women work ing fewer hours. Nor is it the result of different levels of education and experience. Wage gaps occur across sectors and education levels. Women work ing full time and year round in Canada earn 72 percent of what men earn on aver age.15

The wage gap is also evident among racialized, immigrant and indigenous workers. Working full-time, Aboriginal women earn 10 percent less than Aboriginal men and 26 percent less than non-Aboriginal men. Racialized women earn 21 percent less than racialized men and 32 percent less than non-racialized men. Immigrant women earn 25 percent less than immigrant men and 28 percent less than non-immigrant men.16

Gaps in wages and employment levels contribute to poverty, income and wealth inequality in Canada. The richest 1 percent of earners in Canada accounted for 32 percent of all income gains between 1997 and 2007.17 Since the 2009 economic recession, the incomes of the top 1 percent have diminished slightly from their pre-recession peak, as has their share of wealth. However, the richest 1 percent still hold 25 percent of the country’s wealth and have seen their incomes grow at a much faster rate than those of the rest of the population.18 Canada’s over all tax system has become so regressive that the top 1 percent pays a lower share of income in taxes than the poorest 10 percent.

The top income earners in Canada are predominantly male. Men make up 70 percent of the top 10 percent of income earners in Canada. When this is narrowed to those among the top 1 percent of income earners, men’s share of high-income jobs increases to 78 percent.19 Women make up only two of Canada’s 100 highest earning CEOs.20

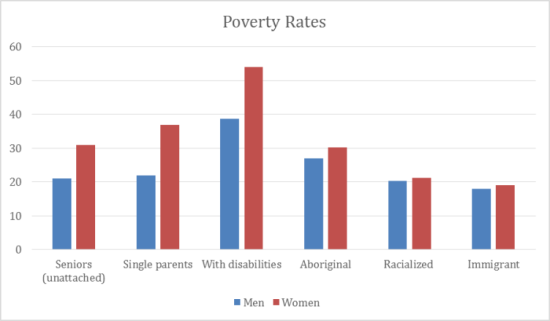

At the other end of the spectrum, women make up the majority of those living in poverty. More than 1 in 3 (37%) single mothers live in poverty.21 Women with disabilities are not only more likely to live in poverty than th ose without disabilities but are more likely than men with disabilities to live in poverty.22 Older women are far more likely to live in poverty than are older men, with 14 percent of women 65 and older living below the poverty line, compared to 9 percent of men.23 That number rises to 32 percent for single women over the age of 65.24

|

Sources: Canadian Income Survey, Canadian Survey on Disability. Ottawa: Statistics Canada.

The path to progress

Implementing the 2030 Agenda for Sustainable Development will require several important policy changes, especially in the areas of taxation, public services and the environment along with closing the equality gaps, particularly with regard to gender as well as between indigenous, racialized, and immigrant workers and the rest of the population.

Tax policy reform

Progressive tax reform can make an important difference in increasing Government revenues and providing the funding for much needed public services. Currently the Canadian tax system taxes capital gains at half the rate at which it taxes employment income. Simply by taxing capital gains at the same rate as employment income, the Government could recover USD 10bn annually—enough to pay for a subsidized universal childcare programme and a national pharmacare programme .25 Restoring corporate tax rates to their 2006 levels would return an addition al USD 9bn annually to the public purse—enough to raise social assistance rates and deliver greater relief to those living below the low-income line.26

Progressive tax reform must also be accompanied by greater regulation of tax avoidance. Canada currently loses an estimated USD7.8bn in tax avoidance each year.27 Investments in additional regulatory capacity pay off. In 2005, the Governm ent invested an additional USD 30 mn in Canada Reve nue Agencies’ international tax compliance division, which yielded USD 2.5bn in recuperated tax revenue over four years. Current projections suggest that an investment of USD 50 mn in 2016 could yield USD 5bn in recovered taxes over the next four years.28

Tax reforms are an essential tool in addressing poverty and inequality and in ensuring that Canada meets its commitments to the Sustain able Development Goals. However, tax policies must be designed to respond to soc ial inequalities. Men and women, for example, respond differently to tax policy – because they have different income levels on average and have different lev els of unpaid work responsibilities.

Tax policies designed without attention to the different impact on men and women can have a negative effect on economic gr owth overall and on women’s economic security. For example, joint taxation policies—those which treat couples as a single tax unit— suppress women’s participation in paid work. Such a policy was introduced in Canada in 201 5. This policy creates a disincentive for the lower earning spouse—usually the woman—to return to the labour market because th e tax break is maximized in single-earner households. This policy also ignored the reali ty of single parents, the majority of whom are women and more than a third of whom live in poverty in Canada.

Tax policies that exacerbate gender inequality h ave a negative impact on the economy as a whole. In every industrialized country where joint taxation (or income splitting) has been introduced, the result is a decrease in female labour force participation, with little or no impact on male labour force participation29 A reduc ed female labour participation rate without a para llel rise in male labour force participation leaves the economy with a smaller, less flexible labour su pply while making women more vulnerable to poverty.

Public service delivery

While tax policies can be a powerful tool, they have a limited impact on those whose incomes are so low that they have no income tax liability. Canada has long supplemented tax policies with benefits paid to those with low incomes, the unemployed, and new parents. If well designed, these benefits can help to lift people out of poverty and reduce inequality .

Employment insurance (EI) can be a protection against poverty in times of economic downturn—but only if the threshold for qualification responds to the reality of increasing levels of temporary, part-time and precarious work. Increased EI rates along with a lower thresh old for qualification can make a significant difference in the lives of the wor king poor.

At the end of their working lives, inequality amongst seniors can be redressed by benefits tied to need rather than lifetime earnings, such as income transfers targeted to low-income families.

Parental leave policies also have implications, in particular for women’s economic equality. While parental leave is available to both mothers and fathers in Canada, 93 percent of that leave is taken by women.30 Paternity leave also shows significant promise in shifting the balance of unpaid work within the family.31 Quebec has followed the pattern of several European countries in introducing a supplemental period of parental leave only for fathers. The leave is most effective when it comes with a high income replacement rate (up to 75% of the father’s employment income is replaced in the Quebec programme ). The result h as been a dramatic increase in the number of fathers taking leave after the bi rth of a child—76 percent of men in Quebec take parental leave compared to 26 percent of men in the rest of Canada.32 The num ber of women taking parental leave has remained stable under the programme. This has the potential to remedy one of the greatest barriers to women’s economic equality: their disproportionate share of unpaid care work.

Environment

Canada’s new federal Government committed to a 1.5-degree-Celsius limit on global temperature rise at the 2 015 Paris Conference on Climate Change. However, the Government must now work w ith provincial governments in Canada to ensure that they can meet this goal. At the moment provincial governments have a wide range of climate and environmental policies in place.

To meet its commitments, Canada ne eds a harmonized national carbon price. Projections suggest that a harmonized carbon price of at least USD 50 per tonne of CO2 must be in place across C anada by 2021 if the country is to approach the 1.5C target.33

In order to offset the impact of t he carbon tax on lower-income households, a portion of carbon tax revenues wou ld be returned to lower-income earners through a green tax refund. The remaind er of the revenues would allow for investments in renewable energy, energy efficiency, public transit, retrofits for low-income housing, and transition measures for the most affected workers and communities.34

Closing the gaps

Closing the gap in wages between men and women and between indigenous, racialized, and immigrant workers is a key part of the return to strong growth in Canada’s economy and security for Canadians. The OECD proj ects that narrowing the gap between men’s and women’s employment in Canada could contribute an additional USD 160 bn or 8 percen t in GDP by 2030.35 Research published by the World Bank suggests that closing the gender wage gap could be worth the equivalent of a 10 percent rise in Canada's GDP.36

Canada’s indigenous population is increasingly young and is growing faster than any other community in Canada. Ensuring that young indi genous people can expect an equal return on their investments in education and training and have equal access to the job market will yield economic growth for Canada, greater economic security for indigenous communities and a return on the current Government’s promise to forge a new relationship with Canada’s First Nations, Métis and Inuit peoples.

The evidence from across OECD countries is clear that the wage gap will not close on its own. In Canada, the gender wage gap has actually increased. The most effective tools for narrowing those gaps include active tracking of wage differences, making wage information public, and supporting wage-setting mechanisms — particularly those afforded by collective bargaining.37 The difference in public- and private-sector wages in Canada demonstrates the impact of transparency, tracking, and unionization — both in addressing the gender wage gap and in narrowing the wage gap experienced by racialized and indigenous workers.38

Conclusion

Canada can afford to be leader in meeting the vision and goals set out in the 2030 Agenda—at home and abroad. While falling oil prices and a lower Canadian dollar have contributed to sl ower growth in Canada, investing in more equal wages and employment and better public supports will yield significant increased growth. These policies will yield a more equal distribution of the benefits of that growth and ensure t hat Canada’s economy is less dependent on the decisions of a small number of corporate actors (who have so far banked most of their tax savings rather t han invest them in jobs and increased wages).

Canada has a historical commitment to human rights, sustainability and equity. With more progressive taxation, be tter public services and real investments in closing the inequality and discrimination gap, Canada can make those commitments a reality.

Notes:

1 “Report on Survey Sent to Parties,” Canadian Council for International Co-operation, Ottawa, 2015.

2 “Macroeconomic Policy,” Alternative Federal Budget 2016.Canadian Centre for Policy Alternatives, 2016.

3 Ibid.

4 Erika Shaker and David Macdonald, What's the Difference?: Taking Stock of Provincial Tuition Fee Policies. Ottawa: Canadian Centre for Policy Alternatives, 2015.

5 Statistics Canada, Survey of Payrolls (SEPH), CAN-SIM table 281-0023.

6 David Macdonald and Kayle Hatt, At What Cost? The Impacts of Rushing to Balance the Budget. Ottawa: Canadian Centre for Policy Alternatives, 2014.

7 Ibid.

8 Ibid.

9 Daniel Wilson and David Macdonald. Shameful Neglect: Indigenous Child Poverty in Canada. Ottawa: Canadian Centre for Policy Alternatives, 2016.

10 National Household Survey 2011, Ottawa: Statistics Canada, 2008. First Nations and Inuit Health: Drinking Water and Waste Water. Health Canada.

11 Jordan Brennan, Do Corporate Income tax Rate Reductions Accelerate Growth? Ottawa: Canadian Centre for Policy Alternatives, 2015.

12 Diane Galarneau and Eric Fecteau , The Ups and Downs of Minimum Wage . Ottawa: Statistics Canada, 2014.

13 Lahouaria Yssaad, The Immigrant Labour Force Analysis Series: The Canadian Immigrant Labour Market: 2008-2011. Ottawa: Statistics Canada, 2012.

14 “Labour Force Status (8), Highest Certificate, Diploma or Degree (15), Aboriginal Identity (8), Age Groups (1 3B) and Sex (3).” 2 011 National Household Survey. Ottawa: Statistics Canada, 2012.

15 “CAN-SIM Table 202-0102: Average female and male earnings, and female-to-male earnings ratio, by work activity, 2011 constant dollars, annual.” Ottawa: Statistics Canada.

16 2011 Nat ional Household Survey . Ottawa: Statistics Canada, 2012.

17 “Poverty and Income Inequality,” Alternative Federal Budget 2016. Ottawa: Canadian Centre for Policy Alternatives, 2016.

18 Ibid.

19 CAN-SIM Table 204-0001: High income trends of tax filers in Canada, provinces, territories and cens us metropolitan areas (CMA), national thresholds, annual. Ottawa: Statistics Canada.

20 Hugh McKenzie, Staying Power: CEO Pay in Canada. Ottawa: Canadian Centre for Policy Alternatives, 2016.

21 CAN-SIM Table 202-0804: Persons in low income, by economic family type, ann ual. Ottawa: Statistics Canada.

22 CAN-SIM Table 115-0014: Total income for adults with and without disabiliti es, by age group and sex, Canada. Ottawa: Statistics Canada; CAN-SIM Table 206-0091: Canadian Income Survey (CIS), low income measures (LIMs) by income source and household size, annual. Ottawa: Statistics Canada

23 CAN-SIM Table 202-0802: Persons in low income families, annual. Ottawa: Statistics Canada.

24 Ibid.

25 “Fair and Progressive Taxation.” Alternative Federal Budget 2016. Ottawa: Canadian Centre for Policy Alternatives, 2013.

26 Ibid.

27 “Tax Havens: Canada’s $199 Billion Problem.” Ottawa: Canadians for Tax Fairness, 2015.

28 “Fair and Progressive Taxation.”

29 See , for example: Janetal Kabátek, “Income taxation, labor supply and housework: A discrete choice model for French couples. ” Labour Economics vol 27, 2014; S. LaLumia , “The Effects of Joint Taxation of Married Couples on Labor Supply and Non-W age Income”, Journal of Public Economics 92 (7): 1698–719, 2008; N. Smit h et al., “The Effects of Taxation on Married Women’s Labou r Supply Across Four Countries”, Oxford Economic Papers 55: 417–39, 20 03; S. Gustafsson , “Separate Taxation and Married Wome n’s Labor Supply: A Comparison of West Germany and Sweden.” Journal of Population Economics 5 (1): 61-85,1992 .

30 Leanne C. Findlay and Dafna E. Kohen,“ Leave practices of parents after the birth or adoption of young children.” Ottawa: Statistics Canada, 2012.

31 Katherine Marshall, “Fathers ‘use of paid parental leave.” Perspectives on Labour and Income, vol 9.6. Ottawa: Statistics Canada, 2008; John Ekberg et al., “Parental leave: A policy evaluation of the Swedish “Daddy- Month” reform.” Journal of Public Economics, vol. 97, 2 013.

32 Findlay and Kohen, “Leave practices of parents after the birth or adoption of young children.”

33 “Environment and Climate Change.” Alternative Federal Budget 2016. Ottawa: Canadian Centre for Policy Alternatives.

34 “Fair and Progressive Taxation.” Alternative Federal Budget 2016. Ottawa: Canadian Centre for Policy Alternatives.

35 OECD, “Table I.A3.1. Projected average annual growth rate in GDP and GDP per capit a in USD 2005 PPP, percentage, 2011–30.” Closing the Gender Gap: Act Now. Paris: OECD Publishing, 2012.

36 Remco H. Oostendorp , “ Globalization and the Gender Wage Gap.” World Bank Economic Review 23 ( 1 ): 141 - 61, 2009.

37 Hadas Mandel, “Winners and Losers: The Consequences of Welfare State Policies for Gender Wage Inequality. European Sociological Review 28 (2): 241–62, 2012; L ouis N. Christofides et al., “The Gender Wage Gaps, ‘Sticky Floors’ and ‘Glass Ceilings’ of the European Union.” Institute f or the Study of Labor Discussion Paper No. 5044. Bonn: Institute for the S tudy of Labor, 2010.

38 Kate McInturffand Paul Tulloch, Narrowing the Gap: The Difference that Public Sector Wages Make. Ottawa: Canadian Centre for Policy Alternatives, 2014.