Supporting private sector with development funds: Putting the cart before the horse?

Published on Thu, 2016-12-01 15:02

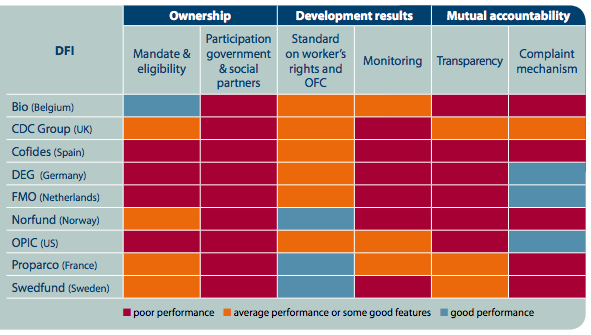

The role of private sector in development is currently one of the most debated issues in international cooperation. It is inscribed in a wider context where financial resources for official development assistance (ODA) are shrinking, development cooperation is evolving beyond the traditional ‘aid’ concept, and the actors/entities that can be key players in development are growing. Fortunately, development is seen more and more as a holistic process that should be supported by integrated global policies (such as trade, investments, etc.), bringing about improvements in terms of both economic and social progress, the latter being based on the full respect of human rights. The pivotal role of business in development discourse is based on the equation between economic growth and sustainable development, (voluntary) corporate social responsibility (CSR), enabling business environment provided by states, and finally public-private dialogues (private sector involved in policy making). The role of business has also been recognised in the United Nations 2030 Agenda for achieving Sustainable Development Goals. Amongst the various consequences of this paradigm, growing percentages of traditional ODA – public resources – are being destined to support private sector initiatives in developing countries. This brings about serious concerns in terms of accountability, ownership, and, last but not least, development results (see also the article in this issue by K. Miyamoto and E. Chiofalo). How can it be ensured that businesses really contribute to developmental processes in the countries where they operate? How can responsibility of their actions be granted against development impacts? How can they be kept accountable for spending public money? These seem quite immediate questions. However, they remain to be answered. Some attempts in this direction have been made but they are still mostly inadequate, such as the Global Partnership for Effective Development Cooperation (GPEDC) indicator on “engagement and contribution of the private sector to development” which is focusing exclusively on the quality of public-private sector dialogue. Obviously this is not sufficient to capture the overall ‘developmental’ impact of private sector. The role of DFIs In recent years, donors have increasingly promoted a new form of engagement: the use of aid to ‘leverage’ the private sector investments for development. The overarching concept is that small amounts of aid can be used to reduce the risk of or remove financial barriers to private sector investments in developing countries, thus mobilising additional funding. Because leveraging combines aid grants with other forms of finance, it is also known as ‘blending’. Unlike other forms of aid flows traditionally managed by aid agencies, leveraging or blending instruments generally involve more specialised financial institutions. The natural choice of donors has been to rely on development finance institutions (DFIs) to manage aid funds and blend them with other public and private finance. However, DFIs do not seem to ‘deliver’ when it comes to adhering to the fundamental commitments enshrined in the development effectiveness agenda, in particular country ownership, accountability, and development results. The average performance of a sample of DFIs is summarised in Table 1. Table 1. DFIs performance on development effectiveness

Source: TUDCN-CPDE (2016), The development effectiveness of supporting the private sector with ODA funds, p. 4: http://www.ituc-csi.org/IMG/pdf/tudcn-dfi_study_web_en.pdf ODA undermines country ownership in Colombia and Peru Case studies from TUDCN-CPDE research provide a useful illustration of how donors use development aid to further the interests of their national companies rather than to target the needs of the poor. This can be seen in the case of Spanish investments in Cartagena (Colombia), in a water supply programme run by a contractor jointly owned by the local municipality and a Spanish-based company. While the number of households with access to water has increased, from 75% to 90% between 2007 and 2013, so too did the price of water, with monthly rates reaching up to 20% of the minimum wage. Each month, 19,000 inhabitants of Cartagena, many of whom are employed in the informal economy and cannot afford the elevated prices, lose access to water due to the non-payment of their bills. In Peru, Canada subsidises CSR policies of some of Canada’s largest mining companies. While the project ostensibly aims to develop the agricultural and forestry sectors within mining communities, its greatest focus is on improving the image of the extractive industry in communities affected by social and industrial conflicts resulting from mining operations. A general bias towards donors’ economic interests and business is assessed within DFIs’ mandates and practices. When it comes to eligibility criteria, the profitability of the projects (less risky situations) is a key requirement across the board. There are only a few DFIs that include mechanisms ensuring investments are directed to micro, small, and medium enterprises (MSMEs), focusing on generating employment or targeting investments to challenged countries or circumstances. Moreover, DFIs’ policies do not include any requirements on participatory approaches – i.e. consulting with national governments in developing countries – and there is no provision either to include social partners (employers and workers’ representatives) in the decision-making processes. Poor labour standards in Malawi and Haiti The Shire Barrage upgrade in Liwonde, Malawi, is part of a project funded through a blend of grants and a concessional loan from the World Bank. The project is supervised by a consortium of European companies. Research based on interviews with workers on the project site and government officials demonstrated weak implementation of work standards and limited development outcomes of the upgrade. Although the World Bank’s International Finance Corporation (IFC) performance standard 2 on labour and working conditions requires workers to be informed about their rights and benefits, none of the workers interviewed were aware of basic labour regulations, and only 23% knew about the existence of a trade union. No on-site monitoring visits were made either by the project funders or the national authorities despite this being foreseen by Malawi labour legislation. These shortcomings represent a clear lack of enforcement of World Bank standards by private sector partners who should have ensured follow-up on these issues given the national context. Furthermore, the project appeared to be using mainly unskilled workers with virtually no training, while skilled jobs have been awarded to foreign experts. As a result, the transfer of skills to local actors has been almost non-existent. In Haiti, the Inter-American Development Bank (IADB) and USAID supported the construction of a special economic zone, the Parc Industriel de Caracol, providing infrastructure for a major textile company. Out of the 6,500 jobs created, an overwhelming majority is under appalling conditions. Approximately 87% of the workers fail to reach the daily minimum wage, as they are paid based on production; there have been reports of irregularities with regards to social security contributions and medical leave as well as threats and failure to pay severances. These examples show that there is still huge concern around the capacity of business, including DFIs, to promote decent work in development countries. This is mainly due to a lack of an inclusive approach, which should always foresee the participation of social partners in all phases of the programme. Labour representation can contribute to strengthen accountability of business, both within DFIs in donor countries (none of the DFIs in the sample are required to have trade unions in their board) and in developing countries where initiatives are implemented. Lack of data prevents accountability in El Salvador and Zambia Case studies in El Salvador and Zambia on programmes to identify and support SMEs, and scaling up lending, proved how impossible it is to obtain information allowing for a thorough assessment of how the funds were being used. No information was available either to assess their impact on the beneficiaries, or detailed information on the specific amounts committed by any of the partners, the specific companies supported, project activities or results. Without any information on the final beneficiaries or the performance of the project, project stakeholders, including the national government, cannot hold project partners or intermediaries to account. These two studies are therefore clear examples of cases in which accountability only runs upwards. These case studies show that DFIs cannot generally guarantee a minimum level of public accountability when using aid funds or other public resources. Project information disclosed by DFIs is very scarce, there is no access to old project files after one or two years and only two DFIs make project evaluations accessible. As a matter of fact, only three DFIs of those analysed have created independent mechanisms to deal with project complaints. Recommendations for a credible approach Current evidence shows that the ‘paradigm’ of the role of private sector in development still needs to be unfolded. This will require political will by both public and private entities. While business is needed to foster economic growth, this alone cannot be sufficient to ensure sustainable development, based on rights and democratic governance. In order to achieve this goal, in line with the 2030 Agenda framework, the following elements need to be explored and reinforced:

By Paola Simonetti, Coordinator of the TUDCN. Source: Trade Union Focus on Development, Issue 60. Tags: |

SUSCRIBE TO OUR NEWSLETTER