Bond to happen? Recurring debt crises in Sub-Saharan Africa

Published on Fri, 2016-12-09 10:25

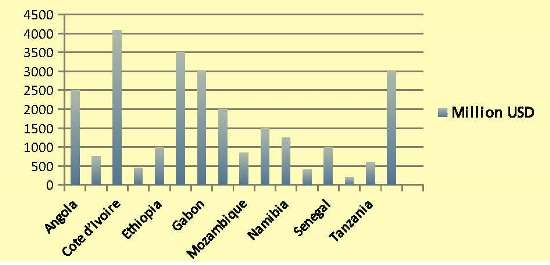

Over the past decade, sub-Saharan African countries have been issuing sovereign bonds at an unprecedented rate and many are now facing new repayment difficulties. A recently-released report, Bond to Happen Recurring Debt Crises in Sub-Saharan Africa and the Rise of Sovereign Bond Issuance, explores the economic and financial situation of a selection of African countries, with a focus on the role of sovereign bonds. It finds that although there are substantial opportunities associated with sovereign bond issuance, there are also substantial risks. The report asks the question: Is there a debt crisis waiting to happen on the subcontinent? And how can we improve our international system for responsible lending and borrowing? As financing for development is central to attaining the Sustainable Development Goals (SDGs), the question of whether the existing frameworks for and practices of contracting debt are likely to be pro-development is of particular concern. So, too, would be the question of their alignment with the human rights framework. Issues where human rights principles are set to make a crucial contribution could be important in the mitigation of the risks posed by high volumes of increased bond issuance. Among other such mitigating aspects, the report discusses transparency and respect for the rule of law in debt contraction process, the estimation of debt sustainability and the principles to be observed by debt investors. Sub-Saharan African Debt: Levels Rising, Transparency Lacking The report finds that many sub-Saharan African countries have undergone substantial transformations with respect to the type of finance they have been attracting over the past decade. Private flows are becoming more important while the importance of public flows is diminishing, particularly for the middle-income countries in the region. A crucial characteristic of the changing flows to the region is the growing importance of sovereign bonds issued in foreign currency, so-called Eurobonds. Although this form of financing is a form of debt issuance, this report finds that investors rarely apply principles for responsible lending when making such investments. Since 2006, sixteen sub-Saharan countries have issued Eurobonds and many have issued more than one. Such bonds are considered to be a much-needed source of financing for development expenditures as well as a convenient way to plug budget deficits. These issuances have amounted to over USD 25 billion in total, which represents about 20 per cent of foreign aid to the region. However, last year the IMF cautioned African countries that they could be endangering their debt sustainability by issuing sovereign bonds. Figure 1. Sub-Saharan African Eurobonds by Country for 2006-2015 (million USD)

The case studies of a small selection of sub-Saharan African countries expose a lack of accountability when it comes borrowing processes. In fact, the process of bond issuance is often plagued by lack of transparency and ultimately legitimacy, from the perspective of the citizens of the issuing country. In some cases, civil society and parliamentarians have little information about the loan contracts and what the funds are being used for. Additionally, civil society groups are demanding to be a part of the decision-making process and for there to be public debates about the use of the borrowed funds and the terms of the loans. A Flawed Global System The global system for evaluating debt sustainability and macroeconomic outlook is also flawed and non-transparent. Credit rating agencies highly influence the level of interest countries will pay on their loans, as their credit rating tends to signal the strength of their economy. However, there is little openness about how these ratings are determined and they tend to focus on short-term issues such as a change in terms of trade, rather than more structural issues such as the type of investment a government is making. (Thus a country experiencing an oil boom will be considered a good borrower in times of high oil prices and a worse borrower in times of low oil prices). Furthermore, the investment banks consulting with sub-Saharan African countries on their bond issuances tend to recommend exaggerated interest rates. Thus, the sub-Saharan African countries end up paying higher borrowing costs than what might have been possible on the international market, which is illustrated by how heavily many of the sovereign bonds issuances have been oversubscribed. As this is playing out in the context of a defective framework for sovereign lending and borrowing and a flawed system for debt restructuring, issuing Eurobonds entails many serious risks. These risks are amplified by the fact that many of the Eurobonds issued in sub-Saharan Africa do not contain collective action clauses. Such clauses are designed to mitigate collective action problems in debt restructurings and they help prevent creditors from refusing to cooperate in restructuring processes (in order to avoid situations like the one Argentina faced recently). How can the risks be mitigated? When asked what kind of conditions lenders should require of issuing governments before investing in their bonds, civil society groups brought up a range of conditions. For example, that the government should publish how it is planning to spend the money in an accessible way and it should provide space for non-state actors to intervene. The report also finds that one cannot simply assume that a country is following the due process of law, as governments often circumvent the constitution. There has been growing awareness of the ethical behavior of investors in sovereign bonds internationally over the past decade. Not only have individual asset managers sought to establish ethical guidelines for their sovereign bond investments, but the UN also published their own Principles for Responsible Investment (PRI) in 2006. In this context of increasing awareness of ethical investor behavior combined with continuing risks associated with Eurobond issuances, the report recommends that a comprehensive framework for responsible lending practices applied to investments in sovereign bonds be developed in order to ensure:

Finally, the report recommends several areas for reform of the global financial system. Firstly, the report recommends the application of the UNCTAD principles on promoting responsible sovereign lending and borrowing internationally, and particularly in relation to lending through sovereign bond investment. Furthermore, the report recommends the development of an independent, global debt-workout mechanism, as well as an improvement in the quality and objectivity of information regarding a country’s economic situation and outlook. By Ingrid Harvold Kvangraven. Ingrid is a PhD student at The New School and author of the report Bond to Happen. Click here to read the full version of Bond to Happen Recurring Debt Crises in Sub-Saharan Africa and the Rise of Sovereign Bond Issuance. Source: RightingFinance. |

SUSCRIBE TO OUR NEWSLETTER